broward county business tax receipt search

As the Countys tax collector provides treasury services and is the statutory repository for the Official Records of the County. A Local Business Tax Receipt is required for each location you operate your business from and one for each category of business you conduct.

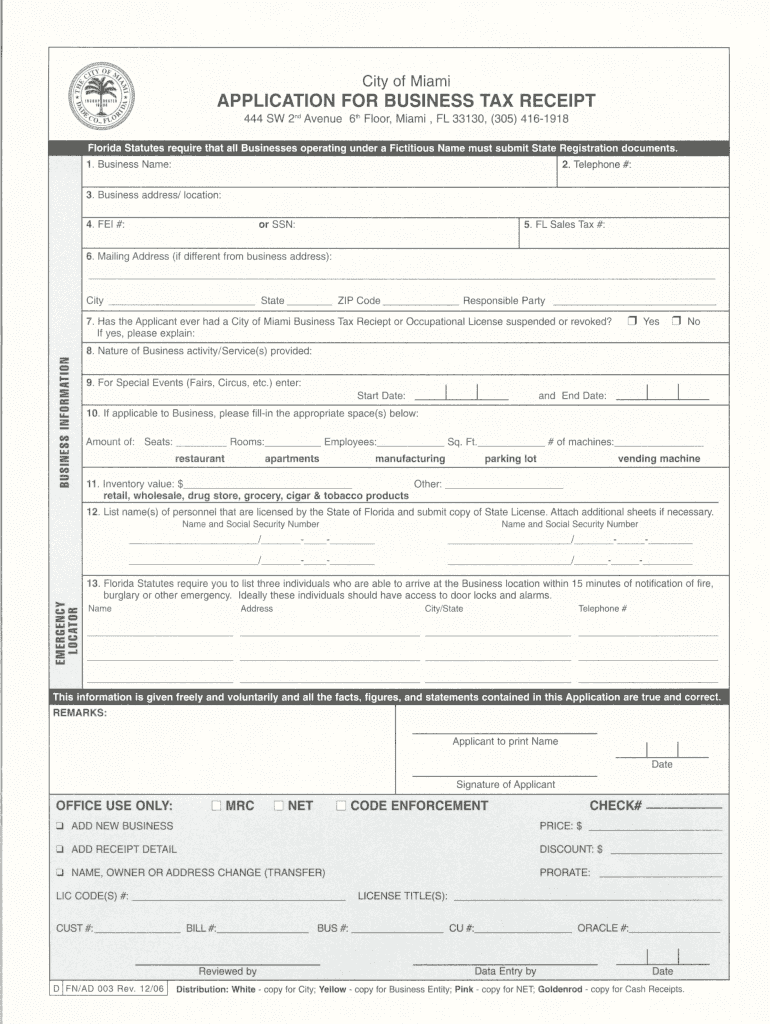

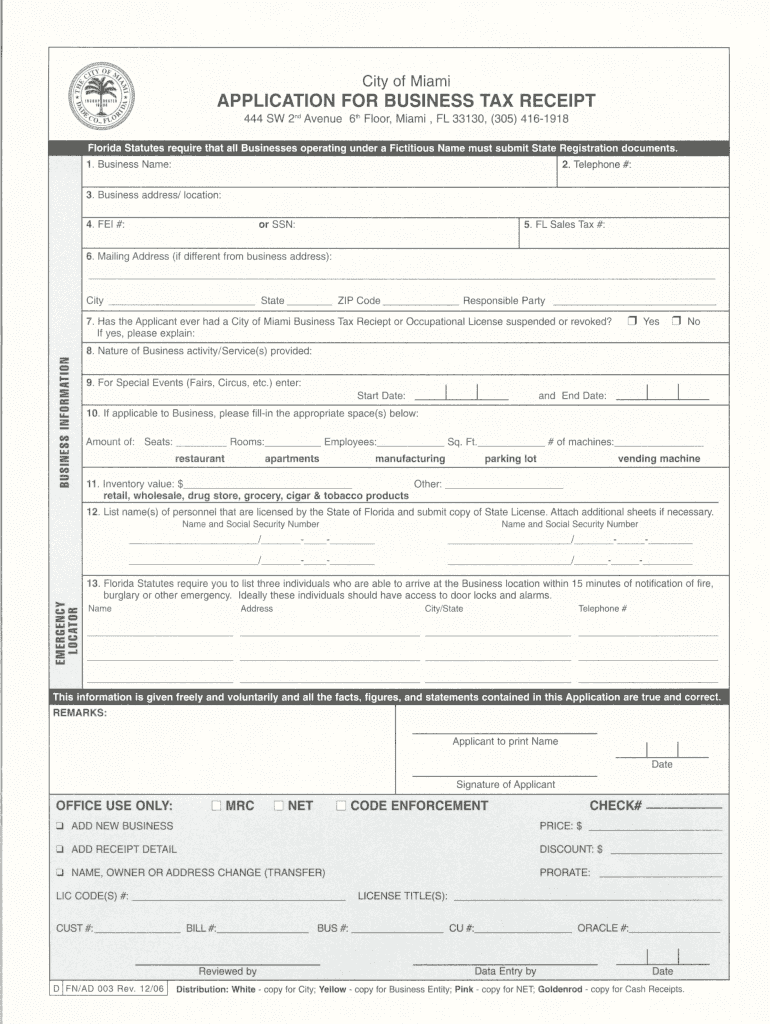

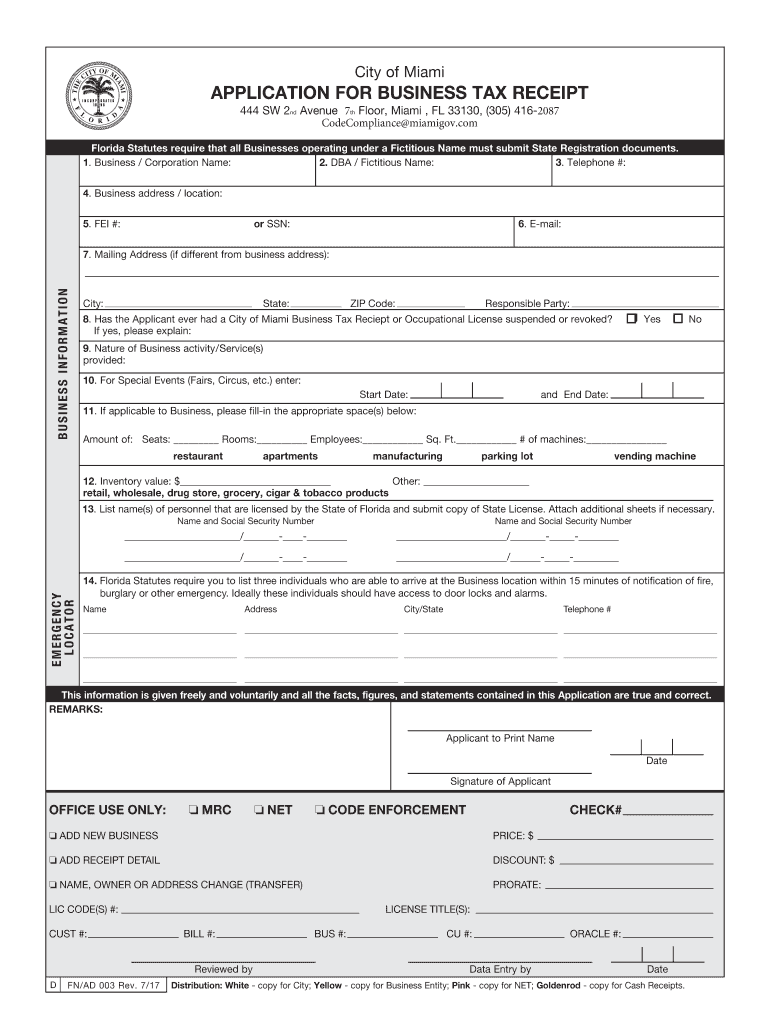

Business Tax Receipt Application Fill Out And Sign Printable Pdf Template Signnow

Each owner must not have a personal net worth exceeding 1320000.

. A Local Business Tax Receipt is required for each location you operate your business from and one for each category of business you conduct. Tax payments are generally processed within 24 hours of receipt up to 3 business days during peak periods. You will need to pay a business tax to operate any business based in the City of Fort Lauderdale.

Per owner 132 million FirmBusiness must be independent 15 or less permanent full-time employees Vendor must have a Broward Business Tax Receipt and be located in Broward County Business must be established for a period of one year prior to submitting. 2021 Property Tax Bill Brochure PDF 220 KB 2021 Taxing Authorities Phone List PDF 72 KB Frequently Asked. The Division part of the Finance and Administrative Services Department collects residential and commercial property taxes local business taxes tourist development taxes and other taxes on behalf of various authorities.

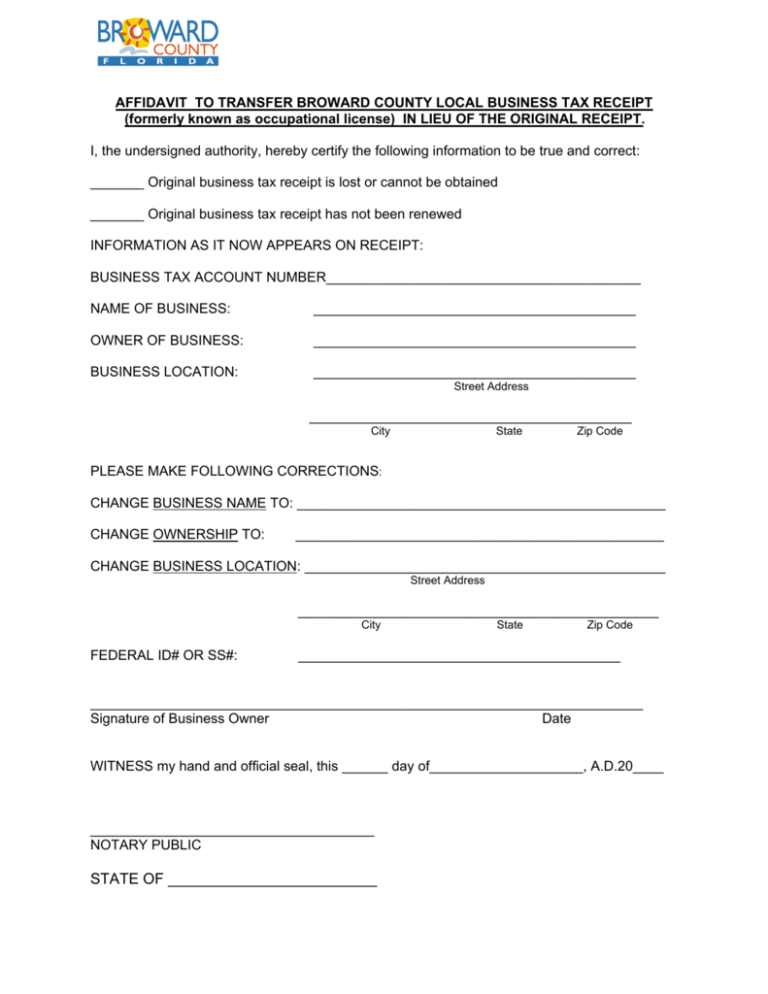

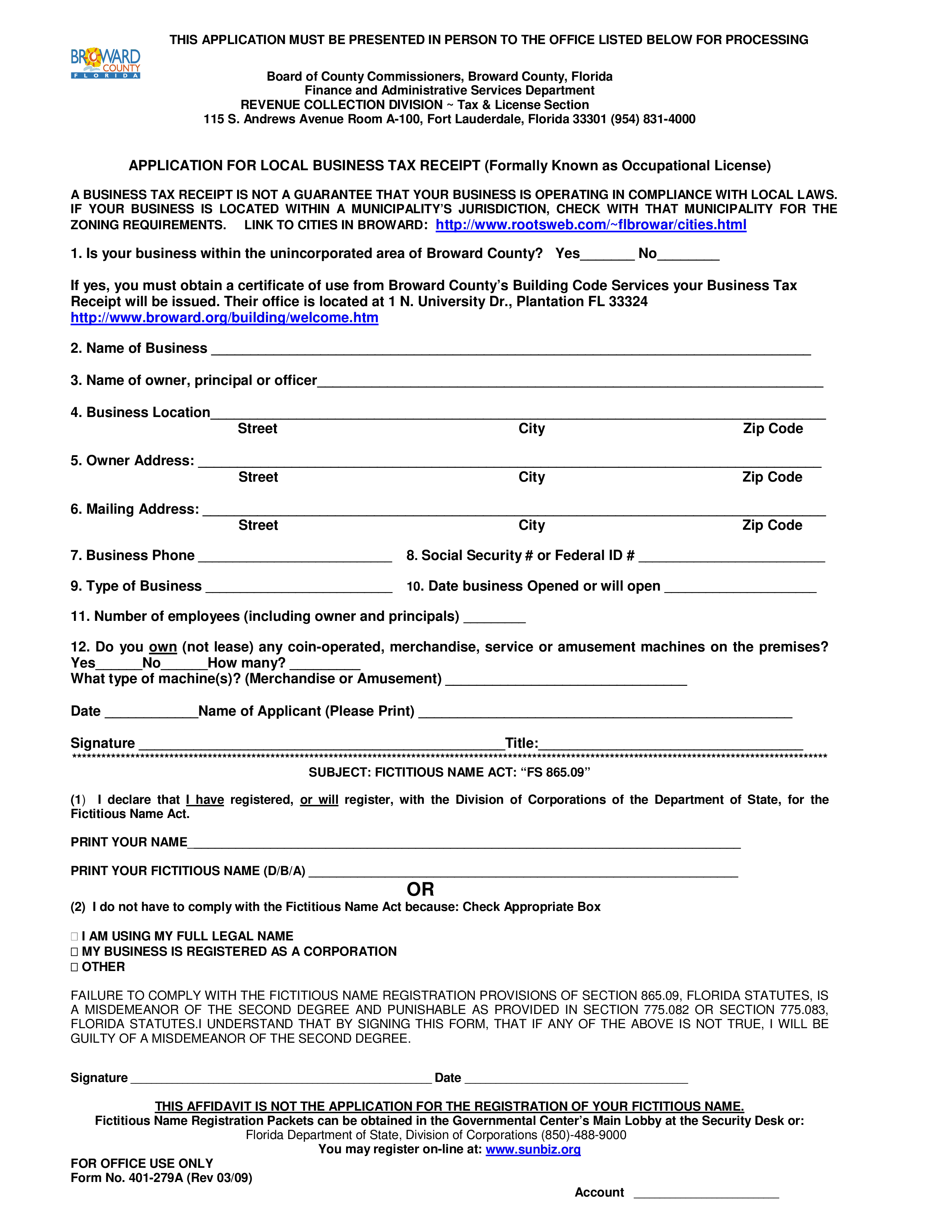

Broward county local business tax receipt. State of Florida Administrative Code 68A-6002 State of Florida Fish Wildlife Commission - Permits and License Applications Local Business Taxes Affidavit for Transfer of Local Business Tax Receipt When Original Receipt Cannot Be Presented PDF 131 KB Application For Out Of BusinessFire Sale Permit PDF 76 KB Local Business Tax Receipt Application Form. Records Taxes and Treasury DivisionCurrently selected Records Motor Vehicle Information Pay Property Taxes Pay Tourist Development Tax Commission Agendas Glossary Story 1 ACH.

County Commission County Administration Government Meetings Open Government Residents Living in Broward Find Agencies Find Services Find Your District Find Parking Helpful References Volunteer Business Doing Business in Broward Find Agencies Services Find Your Commission District Find Parking Helpful References Contact Visitors Sights and information. The vendor must have a Broward Business Tax Receipt and be located in and doing business in Broward County. The firm must have a continuing operating presence in Broward County for at least one year prior to submitting an application.

Living in Broward Find Agencies Find Services Find Your District Find Parking Helpful References Volunteer Business Doing Business in Broward Find Agencies Services Find Your. County Offers Convenient Way to Pay Property Taxes - Express drop-off service for tax payments November 27th - BROWARD. Taxpayers registering for Tourist Development Tax may be required to obtain a Broward County Local Business Tax Receipt.

If you do not know the property owner you can call the Broward County Property Appraiser at 954-357-6830 or visit the Broward County Property Appraisers website and search by street address to find out who owns a propertyPlease direct questions about the recording process including fees and. The Tax Collectors Office will not be accepting new applications for Local Business Tax Receipts on March 31 2016. The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless specifically exempted.

A Local Business Tax Receipt does not guarantee that your business is operating in compliance with Broward County Zoning and other regulations and is required prior to the operation of any business. When you pay a Local Business Tax you receive a. Local Business Tax Receipt Application Form PDF 135 KB Broward County - Fictitious Name Form PDF 223 KB List of Local Business Tax Receipt Categories PDF 72 KB Local Business Tax Receipt Exemption Application Form PDF 149 KB Property Taxes.

The firm must be independent. NIGP Code of Ethics Vendors Must Comply with All State and Local Business Requirements All vendors located within Broward County must have a current Broward County Local Business Tax Receipt formerly known as an Occupational License Tax unless it is exemptAll corporations and partnerships must have the authority to transact business in the State of. Economic and Small.

A CU if required. A Local Business Tax Receipt does not guarantee that your business is operating in compliance with Broward County Zoning and other regulations and. If your question is not answered here then send an email to the Broward County Zoning Official or call.

Urban Planning Division Zoning Certificate of Use FAQs. Your search of the Official Record must be by property owner. When you pay a Local Business Tax.

When you pay a Local Business Tax. The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless specifically exemptedA Local Business Tax Receipt is required for each location you operate your business from and one for each category of business you conduct. How do I obtain a Rental Registration Certificate of Use.

The vendor must have a Broward Business Tax Receipt and be located in and doing business in Broward County. Each owner must not have a personal net worth exceeding 1320000. Property taxes local business taxes tourist development taxes and other taxes on behalf of various authorities.

Records Taxes and Treasury DivisionTaxes And FeesTourist Development Tax About Contact Agency Agency Pic Agency. Your bill will be stamped and returned to you as proof of your payment receiptOnly full payment of the November amount. If your business is located within an incorporated municipality city limits a City Business Tax Receipt must be procured before a Brevard County Business Tax Receipt can be issued.

Free 5 Sample Business Tax Receipts In Ms Word Pdf

Oakland Park Area Broward County Local Business Tax Receipt 305 300 0364

Business Tax Search Taxsys Broward County Records Taxes Treasury Div

Affidavit To Transfer Broward County Local Business Tax Receipt

Affidavit To Transfer Broward County Local Business Tax Receipt

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Application For Local Business Tax Receipt Templates At Allbusinesstemplates Com